Learning about Form 1098-E and the student loan interest deduction can save you money on taxes. We'll cover the form's purpose, who can get it, and how to claim the deduction. This will help you make the most of your student loan repayment.

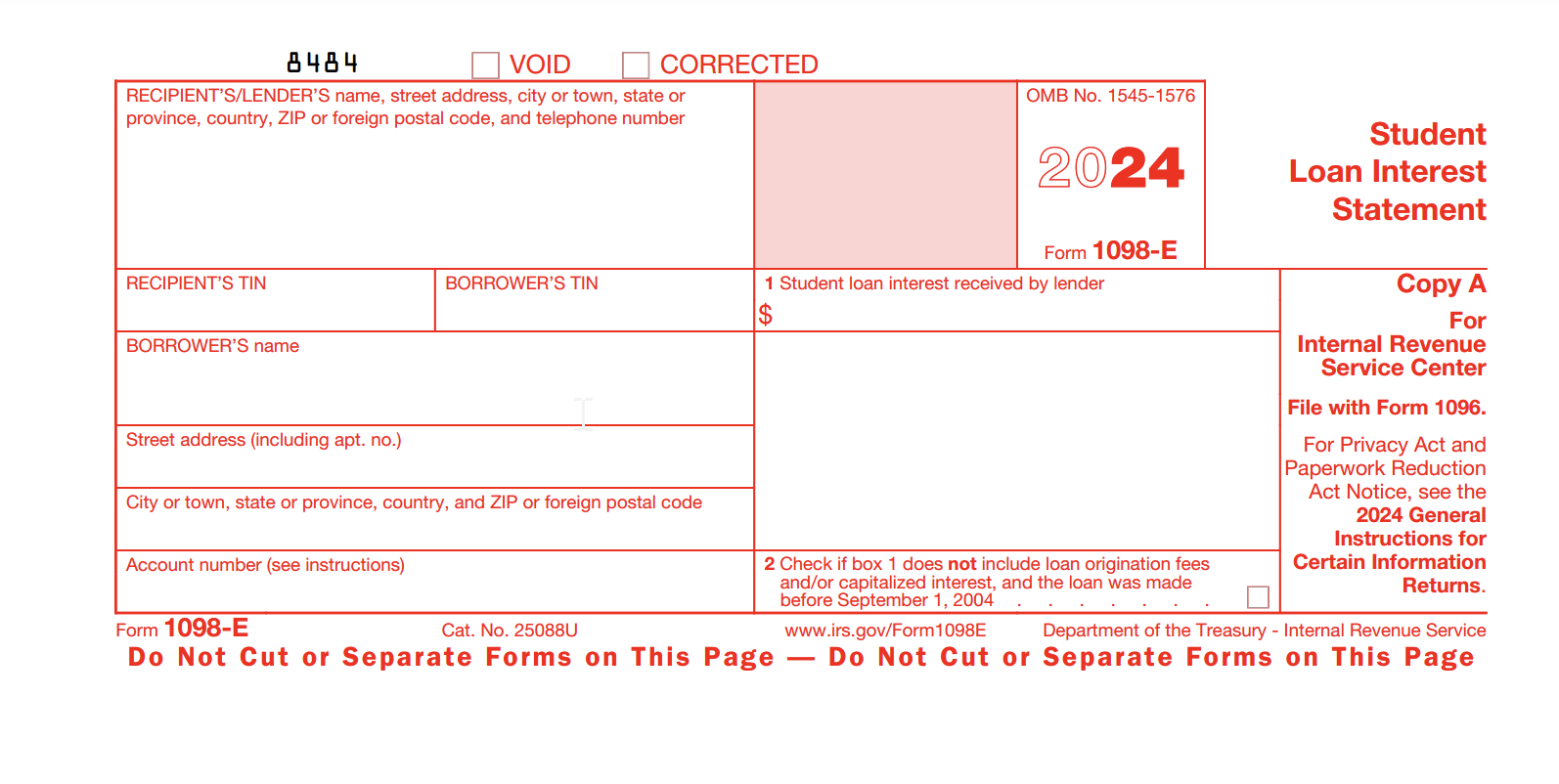

The IRS Form 1098-E, also known as the Student Loan Interest Statement, is important for those who paid interest on their student loans. It's used by federal loan servicers to report the interest you paid during the tax year to the IRS and to you, the borrower.

If you paid more than $600 in interest on your student loans last year, you'll get a 1098-E form. This form is proof of the interest you paid. It helps you claim the student loan interest deduction on your taxes. This deduction can lower your taxable income and reduce your taxes.

Loan servicers must send out IRS Form 1098-E if you paid $600 or more in interest last year. Even if you paid less than $600, some servicers might still send you a 1098-E. If you don't get a 1098-E and paid less than $600, you can ask your loan servicer for the interest amount to report on your taxes.

Students with loans from different servicers will get a 1098-E from each if they paid $600 or more to any one servicer in 2023. Reporting your student loan interest on your 2023 taxes could lead to a deduction. This can lower your taxable income and reduce your taxes.

Loan servicers must send Form 1098-E to anyone who paid $600 or more in interest. They usually send these forms by the end of Januar Students with loans from several servicers might get more than one 1098-E form. If you paid less than $600, you might not get a 1098-E form.

If you paid student loan interest in 2023, you might be able to deduct it on your taxes. This could lower the income you pay taxes on, saving you money. To get this deduction, you must have been legally required to pay the interest. You can't file as married filing separately, and you or your spouse can't be claimed as a dependent on someone else's return.

To use the 1098-E form for a student loan deduction, your income matters. The deduction gets smaller or goes away at higher incomes. If you're single, the deduction starts to decrease when your income hits $75,000. It disappears at $90,000.If you're married and filing together, the deduction starts to decrease at $155,000 of income. It goes away at $185,000.